Are you looking for any services? Contact Us

Are you looking for any services? Contact Us

We take pride in being your preferred partner for Thomas Cook Travel Cards and One Currency Cards. Trust us to provide you with these reliable and trusted travel solutions, ensuring your forex needs are met while traveling.

With these cards in hand, you'll have the peace of mind and forex flexibility to explore the world. Whether you're a frequent traveler or embarking on a new adventure, our partnership with Thomas Cook ensures you have the best financial tools at your disposal.

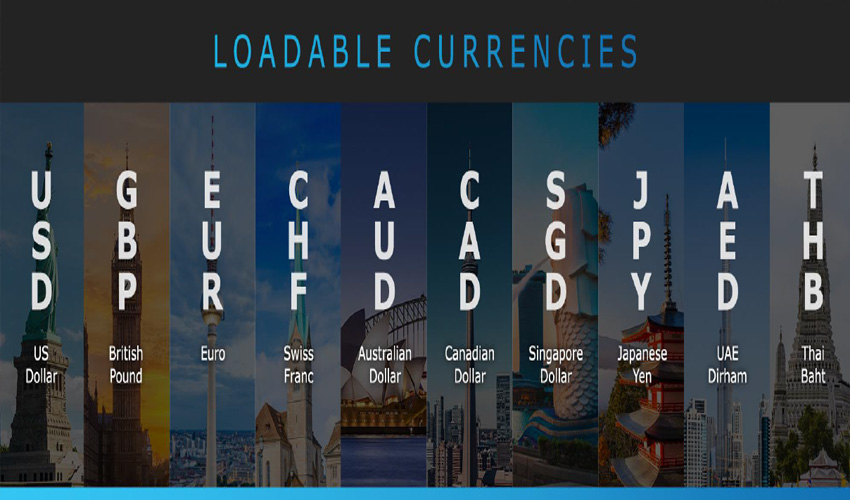

The Borderless Prepaid multi-currency card is the ideal travel companion for all your international trips. It allows you to load nine different currencies in a single card with borderless access to spend in over 200+ countries and securely withdraw local currency from over 3 million VISA ATMs around the world.

• First Such Card In India

• Load 1 Currency (USD) and travel the world

• No Cross Conversion charges

• Load in USD and do transaction in any local currency

• The unique smart multi-currency card enable you to use the appropriate currency loaded on the card based on the country being visited

• Load up to 10 Currencies

• Settle transaction from multiple currency purses in a single transaction.

Before using the card, you should carefully read the manual included in the card package. Forex as a whole is strictly regulated in India, and banks are required to follow all recommendations and instructions made by the RBI while providing services involving foreign exchange. As a result, the same FEMA requirements apply to forex cards, and the issuer of cards must abide by the rules while keeping travellers' interests and safety in mind.

A close reading of the available user manuals will provide clear insight into the costs and charges associated with the card. Although POS swipes are free, there can be fees associated with ATM withdrawals. Never check your card's balance or statement at an ATM while travelling abroad; instead, utilise net banking to avoid fees. In the card kit, you may find the web pin.

To prevent cross-currency fees, always pay at the merchant POS in the currency that is available on your card. Verify that you have enough money on your account for the currency that is being charged if your card has been pre-filled with several currencies. For instance, let's say you are paying your hotel bill in Germany with a credit card that has both USD and EUR on it. Make sure your credit card is being charged in EUR for the billing. Second, you must have enough EUR on the card to cover the entire bill to avoid being charged in USD and incurring cross-currency fees. Charges for converting currencies range from 2% to 4%.

The use of skimming to commit international card fraud is well documented. The card should always be swiped and charged in front of the user.

Determine the total amount of currency needed, how much cash to bring, and the card balance to bring up front. Verify whether the card has the destination currency or not.

• Self-attested copy of passport. • Copy of visa. • Copy of Air ticket. • Self-attested copy of PAN card. When travelling abroad, forex cards are a highly practical and affordable way to carry foreign currency. However, before making the purchase, be sure the card supports the destination currency. It can end up being pricey if the destination currency is not offered on the card. The second and most crucial step is to bring along enough of the target currency in cash to prevent exchange losses at airports. Use your foreign exchange card as much as possible and keep your cash on hand because it offers better encashment rates than any remaining card balance.

Crafted With Care - By. Vast Imagination